Medicare is a federal health insurance program broken up into different parts of coverage — Parts A, B, C, and D. You will generally start with Medicare Part A and Part B (Original Medicare) for your standard, basic inpatient hospital and outpatient medical coverage.

Once enrolled, you will have the option of enrolling in Part D, which is the prescription drug coverage component of Medicare.

You may also enroll in Part C (Medicare Advantage), which will provide you with the same coverage as Original Medicare but may include prescription drug coverage and other possible benefits.

Here is a breakdown of each part of Medicare:

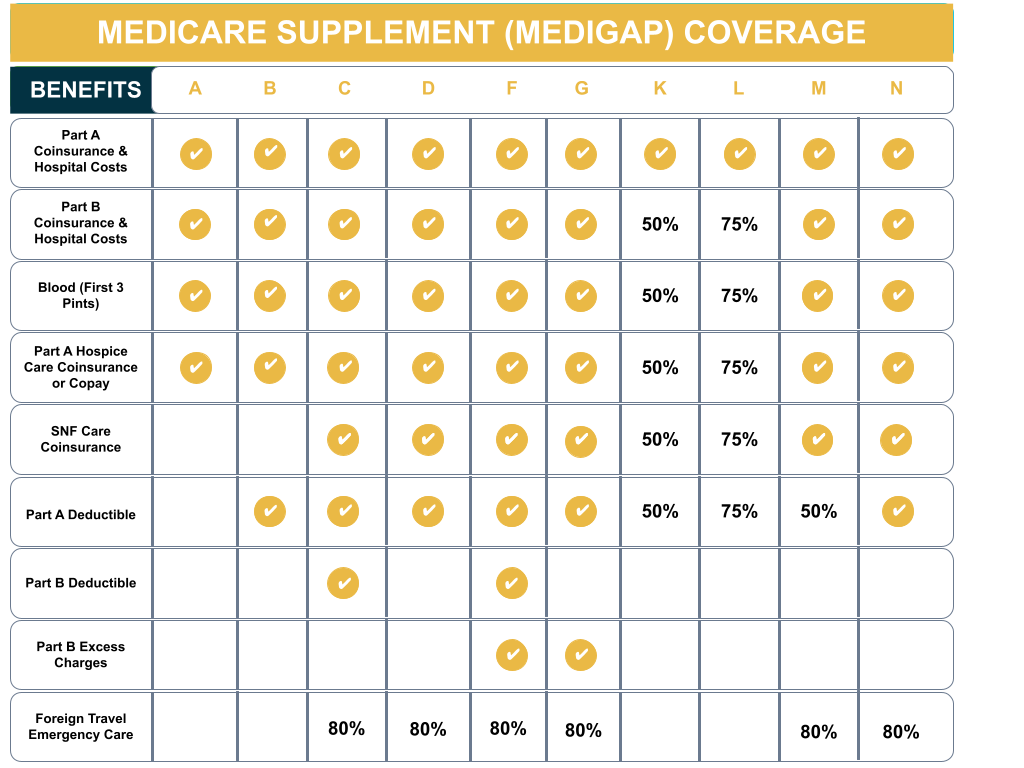

You can also enroll in a Medicare Supplement (Medigap) plan once enrolled in Original Medicare. You can still have Part D while enrolled in Medigap, but you cannot have Medigap and Medicare Advantage at the same time.

The purpose of Medigap is to provide coverage for the out-of-pocket costs not covered by Original Medicare. There are ten Medigap plans you can choose from, but each one will have a varying level of coverage. Here is a look at what each plan covers:

There are two basic ways to become eligible for Medicare:

You can start enrolling in Medicare three months before your 65th birthday. This is called your Initial Enrollment Period (IEP), and it ends three months after your 65th birthday. You aren’t required to enroll in Medicare, but if you don’t do so during your IEP, you’ll have a late enrollment penalty added to your monthly premium.

There’s a lot to unpack regarding Medicare, but don’t let that stop you! Valley Insurance Services makes sure that you’re as confident as can be about your Medicare coverage. Reach out anytime with no strings attached to get your Medicare questions answered.